Treasury bonds in Kenya are secure, medium- to long-term investment instruments issued by the government via CBK.

Investors lend money to the government by purchasing these bonds, and in return, they receive periodic interest payments, typically every six months, until the bond reaches its maturity date.

The Central Bank of Kenya (CBK) acts as an agent for the National Treasury in the issuance and management of these government debt securities.

These types of bonds are an important part of the government’s strategy for raising funds to finance various development projects and operational needs.

Characteristics:

- Issuer: Treasury bonds are issued by the Treasury Department of a government, such as the Kenyan government

- Maturity: These bonds typically have a long-term maturity period, often ranging from 1 to 30 years.

- Interest payments: They pay a fixed rate of interest, known as the coupon rate, which is paid semi-annually.

- Risk: Treasury bonds are considered one of the safest investments since they are backed by the full faith and credit of the issuing government.

- Marketability: These bonds are marketable, meaning they can be bought and sold in the secondary market before they mature.

How to invest in treasury bonds

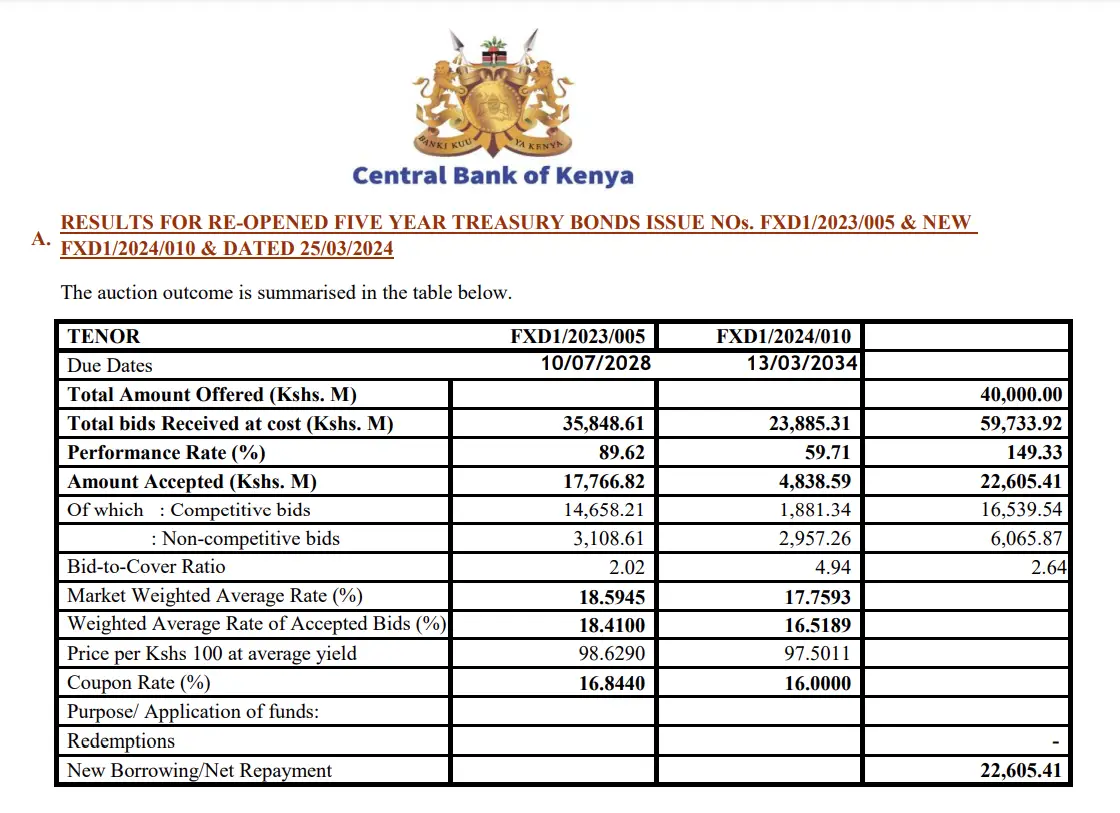

- Auction process: The CBK auctions Treasury bonds on a regular basis. You can submit bids through a licensed commercial bank, stockbroker, or investment bank.

- Minimum investment: The minimum investment amount is Kshs. 50,000.

- M-Akiba: For smaller investments, consider M-Akiba, a mobile phone-based bond with a minimum investment amount of Kshs. 3,000.

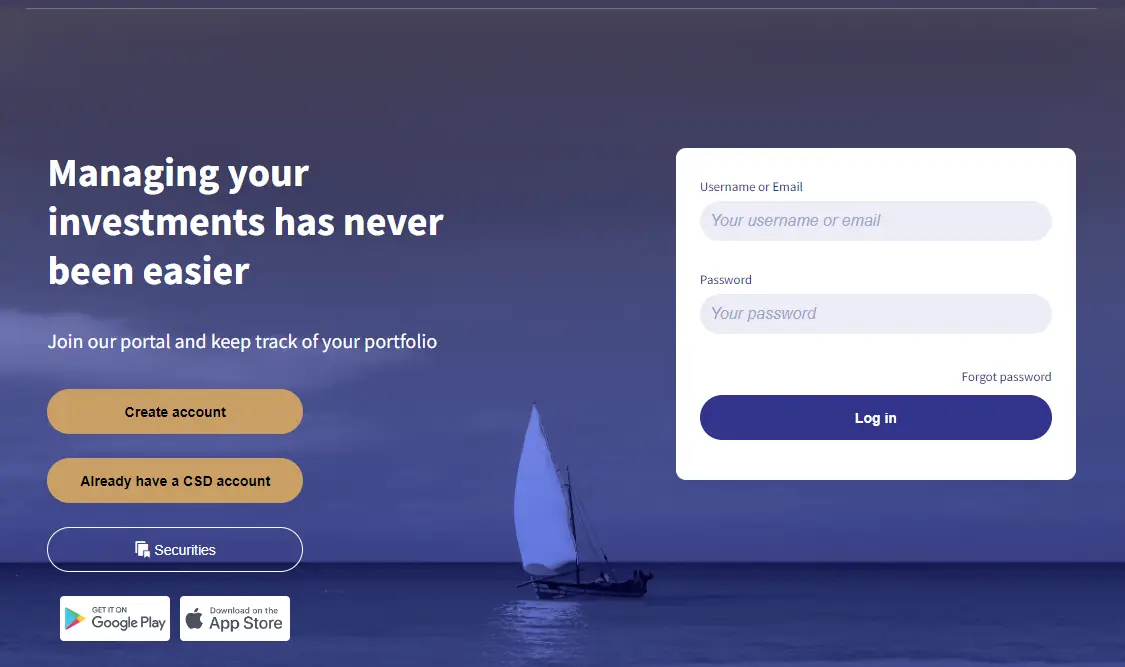

Buying treasury bonds directly via Dhow CSD Portal

The government has launched a portal that enables individuals and corporations to buy and manage treasury bonds directly without going through an intermediary.

To get started, simply visit Dhow CSD and create an investor account.

Requirements and documents:

- Hold a bank account with any Kenyan commercial bank

- Collect a mandate card from the Central Bank or any CBK branches

- Provide your contact and bank details

- Have two signatories from your bank sign the mandate card

- A passport-sized photograph signed and stamped by a representative at your commercial bank

- A clear copy of your National Identity Card, Maisha Card, Passport, or alien certificate.

Whenever you are ready to invest, keep tabs on upcoming treasury bonds prospectuses. CBK usually updates this page whenever there’s a new auction.

There’s also an associated app, but it only has 2.9 star rating, so Moneyspace won’t be covering it, but the web portal is quite intuitive