KRA Paybill (Pay taxes with Mpesa, Airtel, T-Kash and Bank Accounts)

Back to: Home » Mpesa Paybills

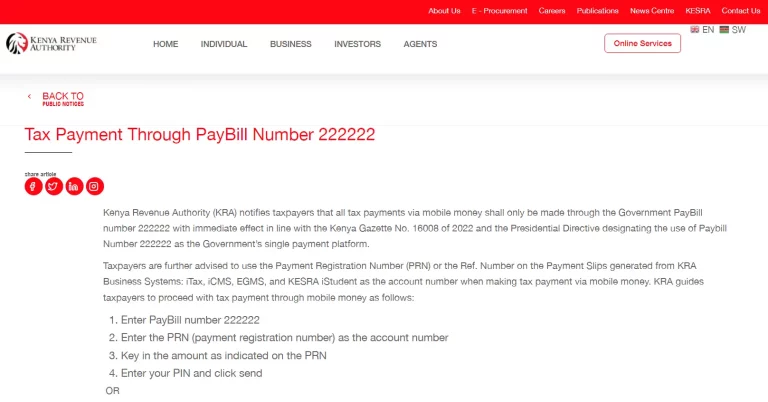

The Kenya Revenue Authority (KRA) has announced a new paybill number 222222 for making tax payments via mobile money.

As per the notice from KRA, “The official Government of Kenya Pay Bill Number is 222222”.

KRA paybill number

Lipa Ushuru na Mpesa

Enter your account number : Enter the Payment Registration Number (PRN) or e-Slip reference number generated from KRA Business Systems

Enter the amount you wish to pay, ensuring it matches the amount on the e-slip/PRN. . e.g. 1520

Click Send and wait for a confirmation from M-pesa and KRA

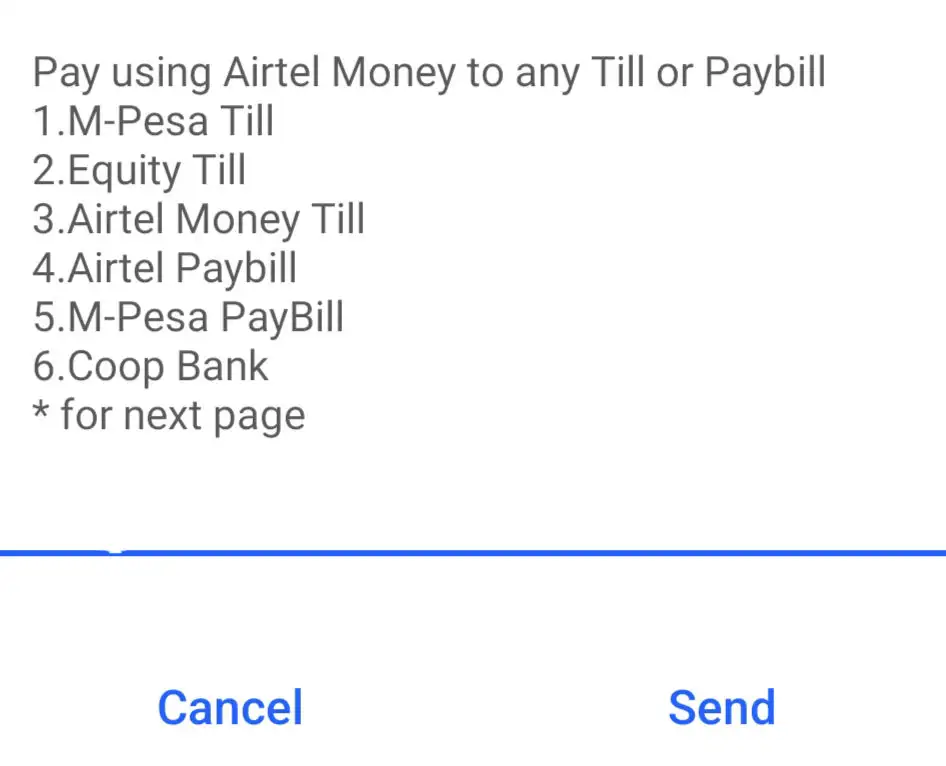

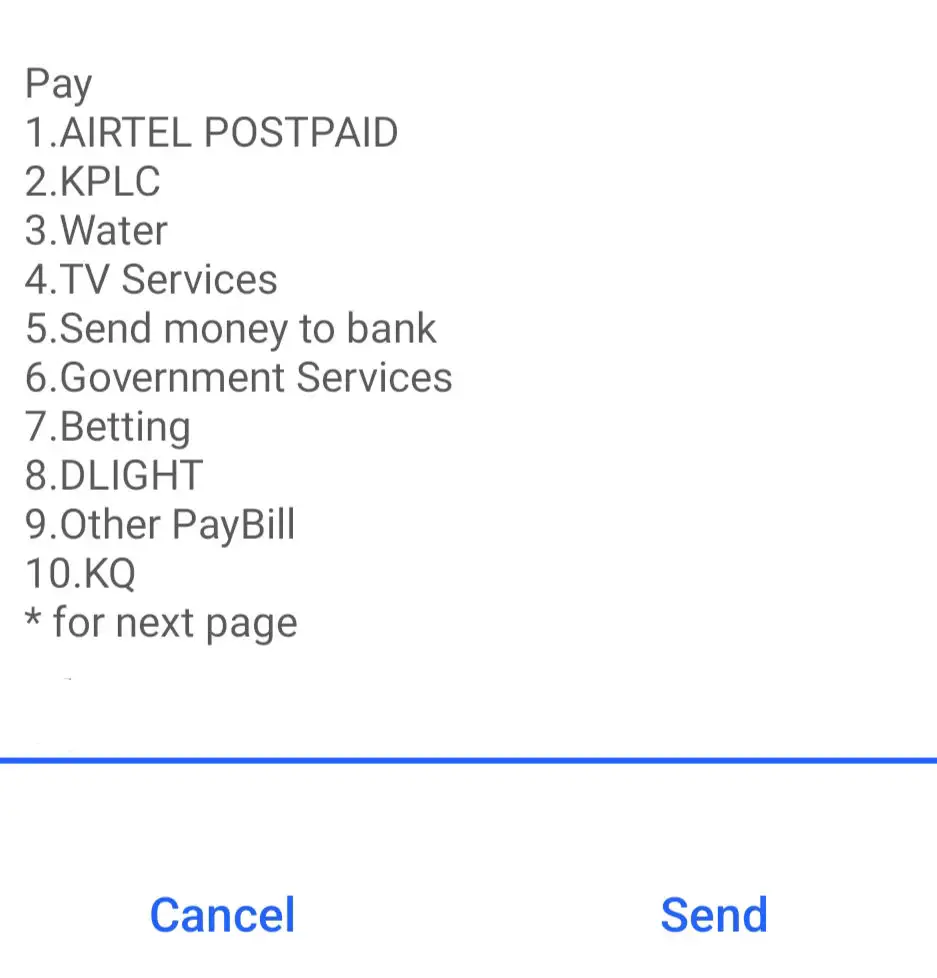

Pay KRA taxes with Airtel Money

Paying your KRA (Kenya Revenue Authority) taxes using Airtel Money is a straightforward process that offers the convenience of fulfilling your tax obligations from anywhere, at any time.

Here's a step-by-step guide to help you navigate through the payment process efficiently:

Step 1: E-Slip Generation

Before making any payment, you need to generate an electronic slip (e-slip) on the iTax KRA portal. This e-slip contains details such as the amount of tax to be paid and the specific tax payment type.

What is a Payment Registration Number?

A Payment Registration Number (PRN) is a unique identifier used in Kenya for making tax payments to the Kenya Revenue Authority (KRA). It replaces older manual payment methods like P11 and VAT3 forms.

Here’s a breakdown how PRN works:

- Electronic Generation: You generate a PRN electronically through your iTax profile on the KRA website.

- Uniqueness: Each PRN has a unique serial number and barcode for every transaction.

- Payment Reference: When making a tax payment (via cash, cheque, etc.), you must quote the PRN to ensure the payment is properly linked to your tax ledger.

- Expiry: A PRN expires after 7 days if not used for payment.

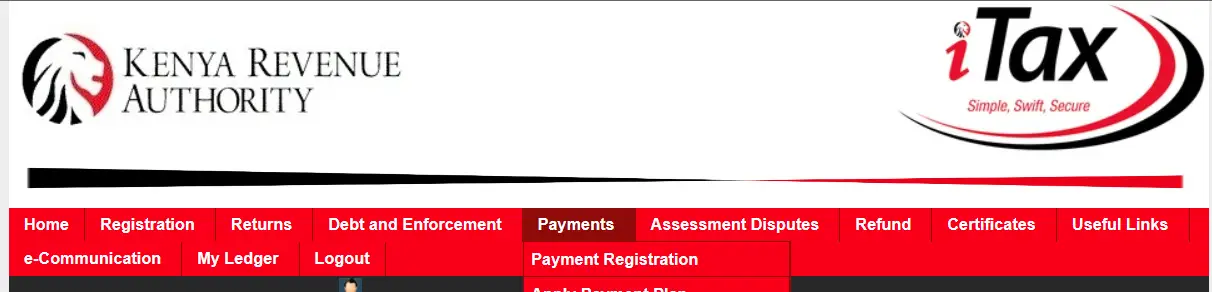

How do I generate PRN or e-Slip?

- Log in to your iTax account on the KRA website

- Navigate to the “Payments” section in your iTax profile.

- Then under the drop-down that appears, click on Payment Registration.

- Select the type of tax you want to make a payment for (e.g., Income Tax, VAT).

- Fill out the required details, including the tax period and amount.

- Click on “Submit” to generate your e-Slip. This will generate a PRN with a unique number and barcode.

Common use cases

- Income Tax Payments: This includes Pay As You Earn (PAYE) for employers and self-assessment tax for individuals.

- Value Added TaxValue Added Tax (VAT) in Kenya is a consumption tax levied on the sale of goods and services. As of , the standard VAT rate is set at 16%. This tax is… … (VAT): Businesses registered for VAT can remit their monthly dues using this service.

- Excise Duty: Manufacturers and importers of excisable goods can use the Paybill to pay their excise duty.

- Stamp Duty: Involved in property transactions? Stamp duty payments can also be facilitated through the KRA Paybill.